Introduction: Understanding the Great Depression

The Great Depression stands as one of the most devastating economic catastrophes in modern history. Beginning with the stock market crash of 1929 and lasting until the late 1930s, this period fundamentally transformed American society, politics, and economic policy. But what caused the Great Depression? This question continues to fascinate economists, historians, and policymakers alike, as understanding its origins offers crucial insights into preventing similar financial disasters.

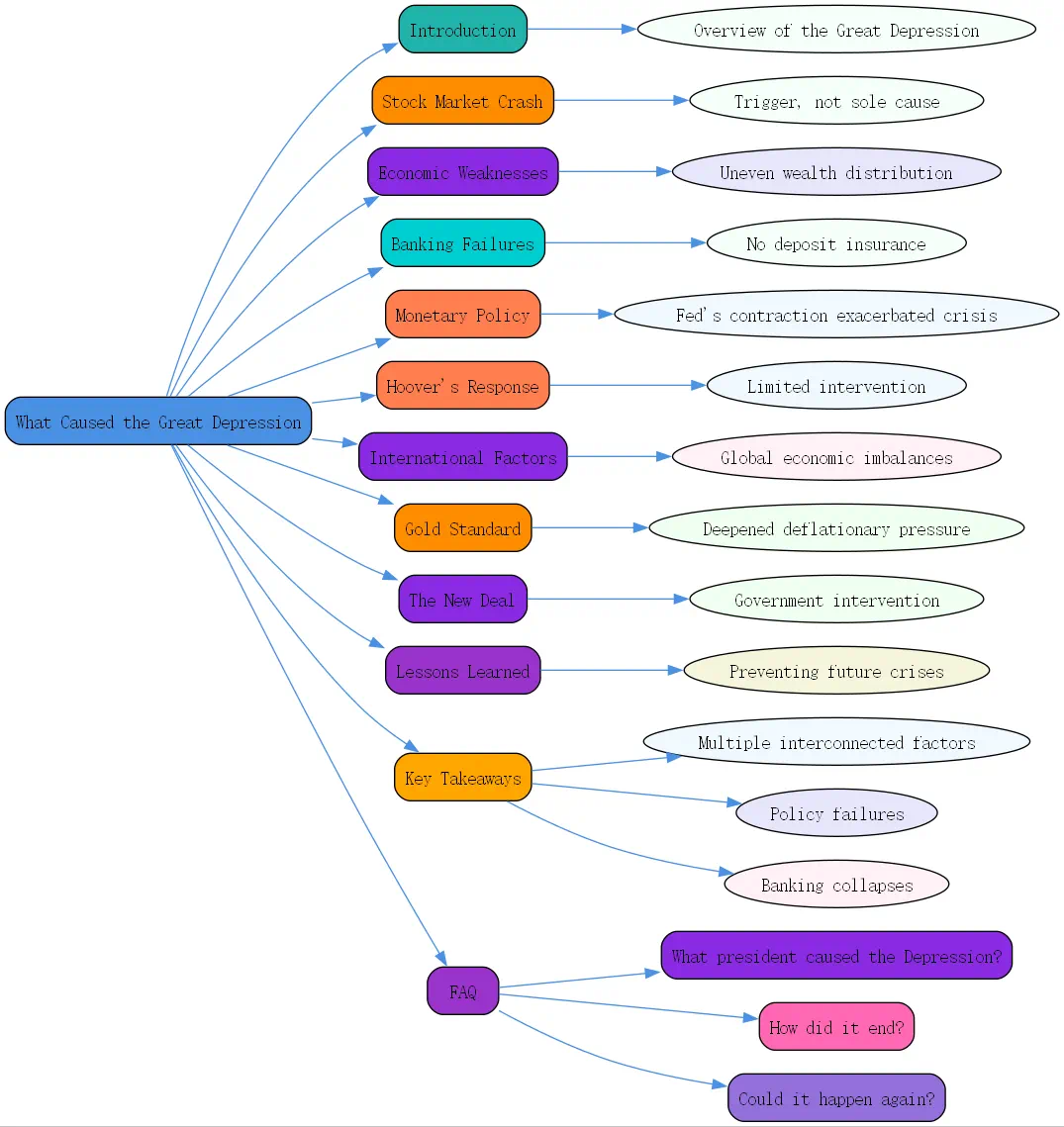

When examining what caused the 1929 Great Depression, we must consider multiple interconnected factors rather than a single event. The economic collapse resulted from a perfect storm of structural weaknesses in the banking system, misguided monetary policies, international economic imbalances, and several other contributing elements that together created an unprecedented financial disaster.

The Stock Market Crash of 1929: The Trigger Point

The stock market crash of October 1929, often referred to as “”Black Tuesday,”” is frequently cited as the event that marked the beginning of the Great Depression. However, it’s important to understand that the crash was more a symptom than a primary cause of the deeper economic problems brewing throughout the 1920s.

In the years leading up to the crash, stock prices had risen to unsustainable levels, fueled by excessive speculation and buying on margin (purchasing stocks with borrowed money). When investor confidence finally faltered, the market collapsed spectacularly, wiping out billions in wealth almost overnight. Between October 24 and October 29, 1929, the Dow Jones Industrial Average lost nearly 25% of its value.

This market collapse had cascading effects throughout the economy. It destroyed investor confidence, reduced consumer spending, and severely damaged the banking system that had become heavily invested in the stock market. While the crash didn’t single-handedly cause the Great Depression, it certainly accelerated and deepened the economic downturn that followed.

Structural Economic Weaknesses Before the Crash

To truly understand what caused the Great Depression, we need to examine the underlying economic vulnerabilities that existed before the 1929 crash. The American economy of the 1920s, despite appearing prosperous on the surface, contained serious structural flaws that made it susceptible to collapse.

One significant weakness was the uneven distribution of wealth. While the 1920s brought prosperity to many middle and upper-class Americans, a large portion of the population remained economically vulnerable. Approximately 60% of American families lived near or below the poverty line, creating a fragile foundation for consumer spending—a critical driver of economic growth.

Additionally, key sectors of the economy were already struggling before the crash. Agriculture, in particular, had been in a depression throughout much of the 1920s due to overproduction and falling crop prices. Rural banks were failing at alarming rates long before the stock market crash, setting the stage for the broader banking collapse that would follow.

Banking System Failures and Monetary Policy Mistakes

The fragility of the American banking system played a crucial role in what caused the Great Depression. Unlike today, banks in the 1920s operated with minimal federal oversight and no deposit insurance. When banks began to fail after the stock market crash, depositors rushed to withdraw their savings, creating “”bank runs”” that forced even financially sound institutions into insolvency.

Between 1930 and 1933, over 9,000 banks failed in the United States, wiping out the savings of millions of Americans and drastically reducing the nation’s money supply. This banking crisis created a vicious cycle: as banks failed, they called in loans and reduced lending, forcing businesses to cut production and lay off workers, which further reduced consumer spending and deepened the economic crisis.

The Federal Reserve’s response to these banking failures has been widely criticized by economic historians. Instead of providing liquidity to the banking system as a “”lender of last resort,”” the Fed allowed the money supply to contract dramatically. This monetary tightening, occurring during a deflationary spiral, only exacerbated the economic contraction.

What President Caused the Great Depression? The Hoover Administration’s Response

When discussing what president caused the Great Depression, it’s important to note that no single president “”caused”” the crisis. However, the policies adopted by President Herbert Hoover’s administration between 1929 and 1933 are often criticized for failing to effectively address the deepening economic collapse.

President Hoover, guided by a belief in limited government intervention, initially responded to the crisis with what he termed “”associationalism””—voluntary cooperation among businesses, banks, and government. He resisted direct federal intervention in the economy, believing that market forces would eventually correct the situation. This approach proved inadequate as the depression worsened.

By 1931 and 1932, as conditions deteriorated, Hoover did implement some interventionist policies, including the creation of the Reconstruction Finance Corporation to provide loans to banks and businesses. However, these measures were too limited and came too late to stem the economic freefall. Hoover’s resistance to direct federal relief for unemployed Americans further damaged his public image and political standing.

International Factors: The Global Nature of the Depression

What caused the Great Depression extended well beyond America’s borders. The international economic system that emerged after World War I contained serious imbalances that contributed to the global nature of the depression.

The war had transformed the United States from a debtor nation to the world’s largest creditor. American banks had lent heavily to European countries to finance postwar reconstruction, creating a situation where Europe’s economic health became dependent on continued American lending. When American investors began pulling back from foreign investments following the 1929 crash, European economies suffered severe setbacks.

Additionally, countries around the world responded to the crisis by implementing protectionist trade policies, most notably the Smoot-Hawley Tariff Act passed by the United States in 1930. These trade barriers severely reduced international commerce, deepening the global economic contraction. By 1932, world trade had fallen by approximately 66% from its 1929 levels.

The Gold Standard’s Role in Deepening the Crisis

The international gold standard, which linked major currencies to fixed amounts of gold, played a significant role in what caused the Great Depression to spread globally and persist for so long. Under this system, countries experiencing economic difficulties were forced to deflate their economies to maintain their currency’s gold value.

This deflationary pressure intensified the economic contraction in countries adhering to the gold standard. Nations that abandoned the gold standard earlier, such as Great Britain in 1931, typically recovered from the depression more quickly than those that maintained it longer, like the United States (which remained on the gold standard until 1933).

The constraints of the gold standard limited countries’ ability to pursue expansionary monetary policies that might have alleviated the depression. This monetary straightjacket is now widely recognized by economists as a key factor in the depression’s severity and duration.

The New Deal and Recovery

The election of Franklin D. Roosevelt in 1932 marked a decisive shift in the federal government’s approach to the economic crisis. Roosevelt’s New Deal programs represented an unprecedented expansion of government intervention in the economy, implementing banking reforms, agricultural subsidies, public works projects, and social security.

While debates continue about the effectiveness of specific New Deal policies, Roosevelt’s willingness to experiment with different approaches and his commitment to providing relief to suffering Americans represented a significant departure from his predecessor’s more limited response. The psychological impact of Roosevelt’s leadership, particularly his famous assertion that “”the only thing we have to fear is fear itself,”” helped restore public confidence in the government’s ability to address the crisis.

Full recovery from the Great Depression ultimately came with America’s entry into World War II, which created massive government spending and essentially eliminated unemployment. However, the institutional reforms implemented during the New Deal—particularly banking regulations and social safety net programs—created a more stable economic foundation that helped prevent another depression of similar magnitude.

Lessons Learned: Preventing Another Great Depression

Understanding what caused the Great Depression has proven invaluable for preventing similar economic catastrophes. The 2008 financial crisis, often called the “”Great Recession,”” tested many of the lessons learned from the 1930s. Unlike during the Great Depression, policymakers in 2008 responded with aggressive monetary expansion, bank bailouts, and fiscal stimulus—measures directly informed by analysis of what went wrong in the earlier crisis.

The Federal Reserve, learning from its 1930s mistakes, flooded the financial system with liquidity during the 2008 crisis. Bank deposit insurance, created during the New Deal, prevented the kind of devastating bank runs that characterized the Great Depression. These policy responses, while controversial, likely prevented the 2008 recession from developing into a full-blown depression.

At BrainTalking, our economic historians emphasize that continued study of what caused the Great Depression remains essential for economic stability. By understanding the complex interplay of factors that led to this historic crisis, we can better identify warning signs and implement appropriate preventive measures when similar conditions arise.

Key Takeaways: What Caused the Great Depression

- Multiple factors: No single cause explains the Great Depression—it resulted from interconnected economic vulnerabilities and policy failures

- Stock market crash: The 1929 crash triggered but didn’t solely cause the depression

- Banking failures: Thousands of bank collapses destroyed wealth and contracted the money supply

- Policy responses: Inadequate government intervention initially worsened the crisis

- International dimensions: The gold standard and protectionist trade policies deepened and globalized the depression

- Wealth inequality: Uneven distribution of prosperity in the 1920s created an unstable economic foundation

- Monetary contraction: The Federal Reserve’s failure to provide liquidity exacerbated the economic contraction

FAQ: Common Questions About the Great Depression

What president caused the Great Depression?

No single president “”caused”” the Great Depression. While Herbert Hoover was president when the crisis began, the economic vulnerabilities that led to the depression developed over many years before his presidency. Hoover’s policy responses have been criticized as inadequate, but attributing the entire crisis to his administration oversimplifies the complex economic factors involved. What caused the Great Depression was a combination of structural economic weaknesses, international financial imbalances, and policy failures rather than the actions of any one president.

How did the Great Depression finally end?

The Great Depression ended largely due to the massive government spending associated with World War II. Military mobilization created millions of jobs and stimulated industrial production. Additionally, the institutional reforms implemented during the New Deal—including banking regulations, labor protections, and social safety net programs—created a more stable economic foundation. The abandonment of the gold standard in 1933 also freed monetary policy from deflationary constraints, allowing for more effective economic management.